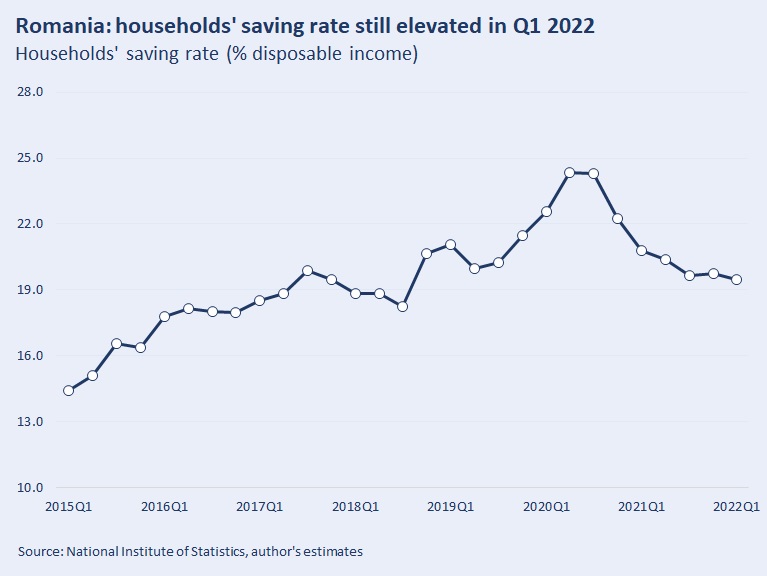

Households’ saving rate*** has been on a downward trend over the last quarters, reaching a level of 19.5% in Q1 2022. This level was only marginally below those recorded in Q3 2021 and Q4 2021, and not very much below the level of 20.6% recorded in the pre-pandemic year 2019.

So, households’ saving rate remained elevated in Q1 2022 despite the sharp increase in consumer prices. Fast advance of disposable income allowed the households to expand their spending rapidly, without reducing their saving ratio too much.

Households’ spending increased by 16.5% yoy in nominal terms in Q1 2022 as a result of an increase in volume of purchases of goods and services and of increase in prices paid for such purchases. However, increase of disposable income was also fast in Q1 2022, totaling 14.6% yoy. Wage earnings increased by 12.1% yoy, while households’ income from social transfers (pensions, children allowance, and other social transfers) increased much faster, i.e. by 18.6% yoy.

I expect the saving ratio to continue on a downward trend from Q2 2022 onwards as increase in nominal revenues would not keep pace with very rapid increase in nominal spending that would be boosted by fast increase in prices.

*** Note: my estimates for households’ saving ratio are using the quarterly Household Budget Survey data published by the statistical office and that are seasonally adjusted by me; also, only cash revenues and expenses are used in computations; a different and much lower saving rate results when using National Accounts data.